When are Credit Cards Charged

Overview

This page discusses the options available for when credit cards are charged

When are Credit Cards Charged?

Processing credit cards may seem like one of the easiest things in e-commerce, but in reality there are a tremendous amount of options available to you on how the processing takes place. This document will attempt to explain some of the ways UltraCart behaves based upon the configuration options you select.

Here is a summary of your options.

Option | Discussion |

|---|---|

Real-time charge during checkout=YES | Can check CVV and CVVs numbers. Most merchant use this. |

Real-time charge during checkout=NO | Order is charged you click |

Most merchants use the "Auth and Capture" authorization model (discussed below). If you chose "Auth then Capture" , the card is authorized during checkout, but the funds are not captured until you mark the order Shipped from the Shipping Department screen.

Real-time Charge During Checkout

The first configuration option to discuss is real-time charge during checkout. If you navigate to:

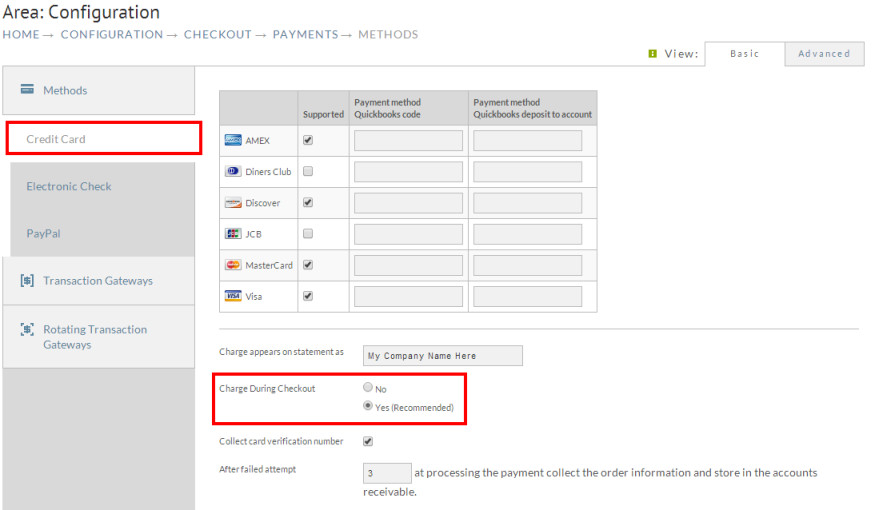

Home → Configuration (Checkout) → Payments → (middle menu) Credit Card

The screen shot below shows the option for having real-time charge during checkout on or off.

We recommend having the option set to Yes so that the customer's card will be charged during the order process. If the card declines they will be given a message about the decline and can change the card to a different one. If you have real-time charge during checkout set to No then all of your orders will go, without the card being verified, into Accounts Receivable located at:

If you have real-time charge set to No then you can not check the card's CVC/CVV2 number. PCI regulations prohibit databasing this value. Only in a real-time charge during checkout scenario can the CVC/CVV2 number be used.

Options for Real-time Charge During Checkout Enabled

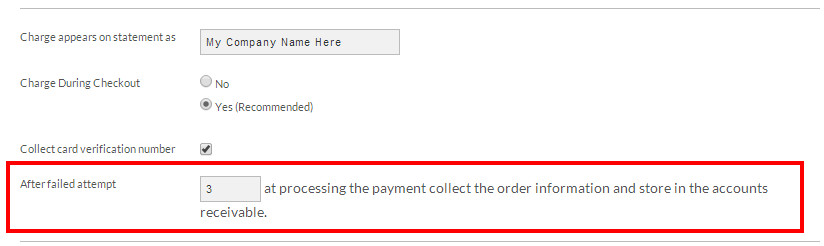

If you have real-time charge during checkout enabled there are a few more configuration options available to you as shown below.

Field | Description | Recommended Setting |

|---|---|---|

After X attempts capture order to Accounts Receivable | If your profit per order is such that spending the time on customer service to obtain a new credit card if the customer is having trouble is worth it then this option should be set | 3 |

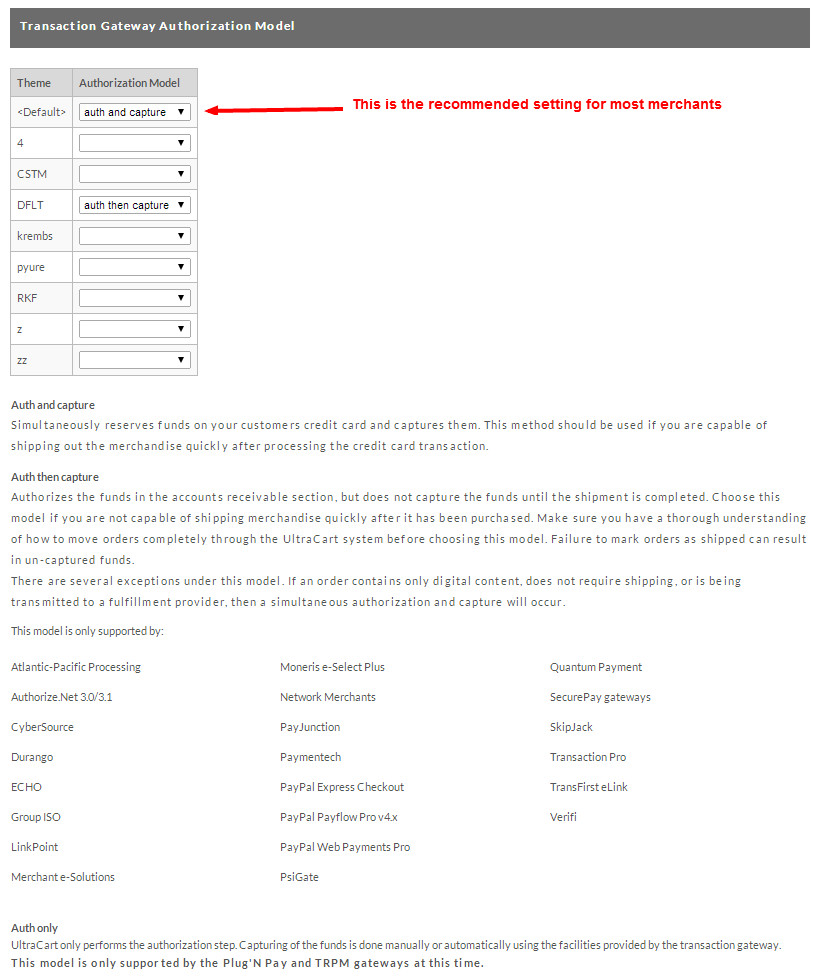

Understanding the Credit Card Authorization Model

The credit card industry allows for two different types of transactions to take place. The first and most common type of transaction is a "Sale" transactions (auth and capture). This type of transaction the funds are immediately reserved on the card and the charge will be settled in the nightly batch. If you are quickly shipping merchandise from your warehouse or processing digital goods then this is the transaction model that is recommended.

The second type of processing is known as an "Auth then capture". During the checkout (if you have real-time charge during checkout set to yes) or Accounts Receivable (failed cards or real-time charge during checkout set to no) an authorization is pulled on the credit card for those funds. The authorization will reserve funds on the card for 7-28 days depending upon the financial institution where the credit card is issued. After the order is shipped, the system makes a second credit card transaction to capture the authorized funds and settle them. If you are selling products that are likely to be canceled or take a long time to ship then this model is more suitable. Please consult with your payment gateway and merchant account provider to determine if there are increased fees for using this type of model.

You can control which model your store uses under:

Home → Configuration (Checkout) → Payments → Transaction Gateways (Advanced View required)

At the bottom of the page you will see a section for Authorization Model as shown below.

More advanced users can set the authorization model by screen branding theme for they have multiple themes.

What if my fulfillment house processes my credit cards?

This scenario is not recommended unless your fulfillment house is also providing the customer service and has an integrated system for handling refunds, etc. If you fall into this category then you will need to contact UltraCart support to:

- See if the existing integration with your fulfillment house supports this?

- Setting the proper options on your account to make the integration work.

Sometimes UltraCart will simply collect the information and pass it on to the fulfillment house in an encrypted fashion. More advanced integrations will have UltraCart perform the authorization during the checkout process and then send the authorization over to the fulfillment house to capture.

An authorization by UltraCart and capture by your fulfillment house may require further custom development depending upon the payment gateway and fulfillment house provided.

How do upsells effect payment processing?

When an upsell after offer is configured the payment process gets a little more complicated. The first thing to understand about upsells is that UltraCart guarantees to generate an order from the shopping cart no matter what. So, once they click the finalize order button and the upsell after offer(s) are triggered, a 45 minute timer is started related to processing the payment for the order. If the customer abandons their cart instead of successfully having their card charged and seeing a receipt then UltraCart will attempt one more time to charge the card, then generates the order after the timer expires. If this charge fails, then the order will go to Accounts Receivable with a note in the merchant comments "This order failed during the auto closing of an upsell order."

Now, if the final payment processing attempt is successful, then the order will go to the shipping department (or completed stage for non-shippable orders). There are a couple of common questions about upsell payment processing that we want to cover here.

Q: What about my affiliate conversion pixels not firing because the receipt page is never loaded by the browser?

A: Some customers desperately want to see a receipt for their order. They will drive through the upsell gauntlet clicking yes/no until they are finished. If their card was successful then the customer will see the receipt and the affiliate conversion pixel(s) will fire. If their card declines then they will are not taken to the receipt, they are presented with the finalize order page, giving them a chance to update their billing details and re submit the order for finalization to receipt. They might choose to close the browser out at the point instead of finishing the checkout to the receipt. Regardless, their order will eventually appear in Accounts Receivable where you can perform some further customer service and try to salvage the sale (typically by getting a new credit card details). If you are using a 3rd party affiliate network, the affiliate will not receive credit for the sale in cases where the customer did not complete the checkout resulting in then getting to the receipt (only the UltraCart affiliate system can track these types of conversions).

Q: Some of the finalized orders have messed up information on them. Why is that?

A: Once the customer clicks the finalize order button the first time the 45 minute timer begins. If the customer's card fails the real-time charge during checkout, they are sent back to their cart and are given a chance to update their checkout details and make changes that will be saved when they resubmit the order. We are still going to guarantee that we turn that cart into an order no matter what. In some case, customer backtrack and remove previously entered details and doing so can result in the final captured order having missing field data (even "required" fields.)

Q: Can't I put my affiliate conversion pixels on the first page of the upsell?

A: No! Trust us on this one... there are way more devils in the details of trying this scenario. There is no permanent transaction id assigned that that point. The cart may be further manipulated and open you up to affiliate fraud. The actual conversions for the affiliate will be no less than showing it on the receipt after you perform all the work of removing commissions manually from a 3rd party system for all the orders that fail.

Q: What if the customer leaves during an upsell page? When is the card charged?

A: See the upsell page for details. Short answer: They're still charged. If the receipt page is not shown within 45 minutes of collecting payment information, the order is processed. This covers upsell-rage-quit (which happens when you annoy the customer with too many upsells) or accidental browser closing.

CVV2 and Accounts Receivable

Q: When an order is declined what happens to the CVV2 Code?

A: As part of PCI compliance, we can never database the CVV2 value. If you send an order to Accounts Receivable for decline, fraud review, etc. you'll either have to contact the customer to obtain the CVV2 value over the phone or configure your payment gateway to allow charges without the CVV2.

End Customer Questions

Q: I tried purchasing your product and the charge was declined, but an authorization is still on my credit card. Can you remove it?

A: When a customer goes to purchase a product from your website, UltraCart communicates with you payment gateway such as Authorize.Net, NMI, PayJunction, Stripe, etc. The gateway in turn issues an authorization request to the credit card network. When the credit card network receives the authorization request they place funds on hold for the credit card and return the authorization response to the gateway. At this point in time the gateway can look at the authorization response and decide that it doesn't like the AVS or CVV2 match details and decide that a decline code should be returned to UltraCart. The customer is then told their card is declined, but what about the authorization that the gateway pulled on the customer's credit card? Well, that all depends upon the payment gateway that you're using an how they communicate to the credit card network. It is not uncommon for those authorizations to take a few business days to fall off. That's not a big deal when the customer is using a credit card with a reasonable limit and your transaction does not represent a large portion of their available credit balance. On the other hand, if the customer is using a prepaid credit card with $100 balance and your transaction represents $80, they are going to be mad and probably contact your customer service. If this happens, engage your payment gateway and see what options they have for more quickly removing the authorization from the customers credit card for declined transactions.